In ecommerce, knowing how to price products isn’t altogether unlike the game show The Price Is Right.

Set your price too high and you’ll be knocked out of the game, with shoppers leaving their carts abandoned. But aim too low and another brand might come out on top as the winner.

For many online stores, determining a pricing strategy is often as simple as referring to MSRPs (manufacturer’s suggested retail price) or using a cost-plus pricing strategy (a method in which total cost is calculated before a markup is added on).

But for scaling ecommerce businesses, deciding how much to charge for your products is a bit more complex. Ultimately, customers aren’t thinking about what your potential production costs are. They’re considering what a product is worth, which is entirely subjective.

When it comes to setting product prices, your goal shouldn’t just be your bottom line—it should also be your brand’s reputation. Here is everything you need to know about pricing strategies in ecommerce.

What are pricing strategies in ecommerce?

A pricing strategy is the method that an ecommerce merchant or retailer uses to price their products, taking into account production costs and revenue goals, including average order value (AOV) and lifetime customer value.

Understanding pricing strategy

What a “pricing strategy” is not, however, is a discounted price—although discounting techniques can certainly be part of your overall pricing strategy.

It helps you determine what price point will result in the highest customer acquisition, customer retention, sales, profits or conversion rates—all depending on what your goal is. Your pricing strategy influences a customer’s purchase decision.

In other words, if you price your products too high, you’ll risk abandoned carts and lost sales. But if you price your products too low, you’ll lose out on profits.

According to Shopify’s Future of Commerce Report 2022, price is a key factor influencing 74% of consumers.

There are dozens of pricing strategies, but here are six of the strategies most commonly used by scaling ecommerce businesses.

Pricing strategies for ecommerce businesses

1. Competitor pricing

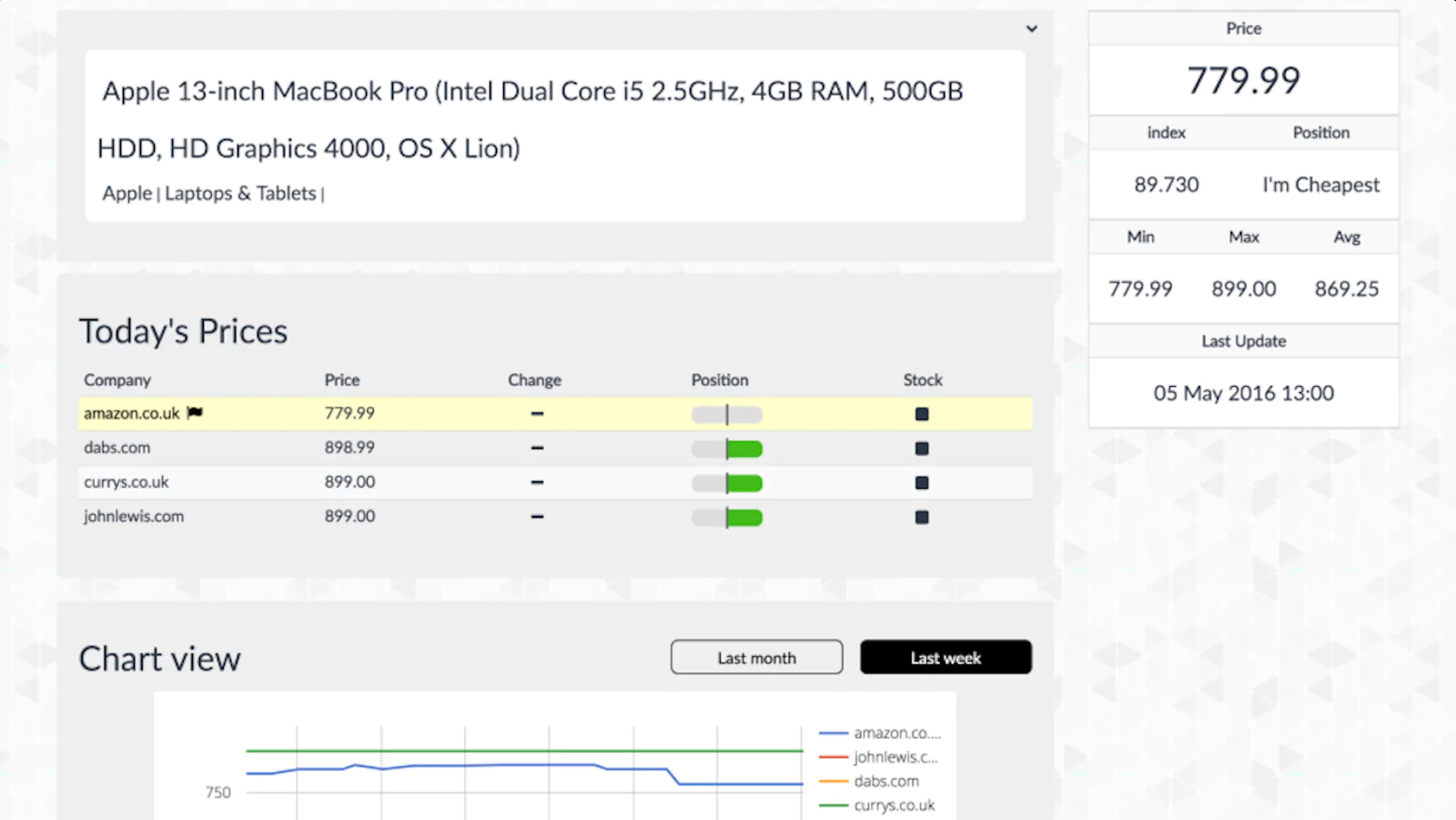

Competitive pricing is a strategy that takes this consumer behavior into consideration, by setting a price based on what your competition charges.

It’s simple and low risk, but it doesn’t take into account your customers’ perceived value of your products. Simply put? You could be missing out on profits by pricing your products too low in a “race to the bottom.”

There are apps to help track competitor pricing and apply dynamic prices for your products. For example, with Prisync, you can automatically set prices to improve profit margins whenever a competitor’s average price changes.

2. Value-based pricing

The preferred method used by many ecommerce pricing analysts, value-based pricing allows you to set a price based on how much customers believe your products are worth.

Compared to competitive pricing and cost-plus pricing, it typically results in higher markups and is more profitable, making it ideal for scaling businesses that are thinking long-term strategy.

Value-based pricing works for merchants who have a differentiating quality, such as sustainability, built into their DNA. More than one-third (34%) of the population is willing to pay more for sustainable products or services, and those willing to pay more would accept a 25% premium on average, according to the 2021 Global Sustainability Study.

This pricing strategy also works particularly well for brands that have a loyal following, such as those selling art, collectibles and luxury or status goods.

However, it’s more difficult to set a price using this method, as it requires extensive market research and analysis. And even if your brand is a household name, you can’t rest on your laurels alone when it comes to value-based pricing.

Case in point: Chanel’s 2021 Advent Calendar. The luxury fashion brand was dragged on social media after its $825 holiday swag turned out to be stuffed with cheap stickers and gift-with-purchase items. (The estimated regular retail value of all the products sat at about $350.)

Although it had a high profit margin thanks to value-based pricing, Chanel was forced to apologize and its reputation was damaged in the process.

3. Price skimming

If you’re selling a product that’s truly innovative or one-of-a-kind, price skimming may be the winning strategy. It involves setting a higher price and lowering it when more competitors emerge and begin offering a similar product. This allows merchants to drive revenue when competition is low, then lower prices to remain competitive later down the line.

Price skimming is most frequently used by tech giants when they release a new product and trust that early adopters will buy in. This is key, as price skimming isn’t successful unless you’re confident your customers will see the forthcoming product as high-quality, exclusive, and worth shelling out for.

4. Penetration pricing

Basically the opposite of price skimming, penetration pricing works best when you’re a brand entering an already competitive marketplace. You’ll want to set your prices low to start and raise them later. This is also where discount codes and strategies can play a critical role in winning over new customers to help develop brand awareness.

The danger of penetration pricing is that it may damage your brand’s reputation or cause consumers to undervalue your products or perceive them as being low-quality.

5. Bundle pricing

A multiple pricing strategy, product bundle pricing is when retailers sell more than one product for a single price. There are several ways this tends to work, with upsells, cross-sells and buy one, get one (BOGO) discounts being some of the most common types of bundling.

While bundle pricing can increase sales volume, it can also run the risk of reducing profits if not done properly.

6. Psychological pricing strategies

Also known as charm pricing, psychological pricing strategies are the reason merchants are more likely to price something at $19.99 than $20.

A technique dating back to the 1880s, countless studies have shown that prices ending in odd numbers—particularly those ending in the number 9—tend to have substantially higher conversion rates. In Priceless: The Myth of Fair Value (and How to Take Advantage of It), author William Poundstone writes that charm prices increase sales on average by 24% when compared to rounded numbers.

While reducing prices by one cent is the most traditional psychological pricing strategy, other methods also fall into this category, such as offering installment payments or using anchor pricing (where the original price is slashed out and placed next to the new price) to increase sales.

There are some tried and true tricks to psychology pricing at play, but most merchants determine which are most effective using A/B testing.

How to choose a pricing strategy

1. Define your objectives

The best pricing strategy is largely contingent on what you perceive your brand to be—and what you envision it will look like in the future.

-

Is your goal to increase your profit margins or AOV?

-

Do you want to retain current customers or focus on attracting new buyers?

-

Do you just want to offload excess warehouse stock?

-

Do you plan on launching your online business internationally?

If the latter is true, you may want to consider employing different pricing strategies according to the regions you’re selling in.

2. Know your customers

Understanding your market demographic, what they value, and how much they’re willing to spend for products is integral to setting the best price and choosing an appropriate pricing strategy.

3. Consider hiring a pricing analyst

For scaling an ecommerce store, creating the right ecommerce pricing strategy is often far more complex than just relying on competitor-based pricing alone.

If your business is growing, it may be time to consider hiring an ecommerce pricing analyst, who can assist you in assessing your production costs, analyzing consumer and market behavior, and monitoring the prices of competition.

Examples of ecommerce pricing strategies

Examples of competitive pricing

Fashion Nova’s influencer marketing strategy was just part of the reason for its meteoric rise within the ecommerce fashion industry. The other reason? Its competitive pricing strategy.

Customers are encouraged to buy products at full price, with an estimated 95% of its products retailing for less than $50. Even the higher price tag won’t break the bank—you can buy a formal dress for just $75.

This isn’t much different from Fashion Nova competitors like Forever 21, and that’s exactly the point. Affordability is built in, meaning the products are accessible to even more price-sensitive customers.

Examples of value-based pricing

Value-based pricing isn’t exclusive to luxury brands. Family-owned and B Corp–certified brand Klean Kanteen knows its target demographic well. While its insulated bottles and thermoses are priced at around $30 to $45, similar products can be found on Amazon for just $15.

So why are customers willing to pay more? It’s not just about Klean Kanteen’s advertised high performance and durability (its products come with a lifetime guarantee). It’s also that its customers are interested in buying from a company that is supporting and preserving the outdoor spaces they adventure in.

Examples of price skimming

Frequently used by tech brands, Apple is perhaps the most famous user of the price skimming strategy. It focuses on offering a small number of high-end products and creating a halo effect, which makes customers thirst for new products. Then, once the early adopters have got the goods and competitors emerge, prices drop.

For example, when the first iPad was released in 2010 (a novel product at the time) a 64 gigabyte model would have set you back $699. With inflation, that’s about $850. But a decade later, the market is flooded with tablets from a range of manufacturers. And now, you can get a brand new 64 gigabyte iPad for just $329.

Examples of penetration pricing

When Netflix launched in the late ’90s, Blockbuster still controlled the home video market. While it was the place to go for Friday date-night movie selection, it offered some drawbacks—namely high rental fees. It cost $4.99 for a three-day rental—and even more if you returned it late.

Enter Netflix. To penetrate the market, it eliminated late fees and offered low pricing, like four movies for less than $16 per month. Once consumers were familiar with the Netflix brand and the competition was entirely wiped out, it was able to raise its prices to maximize profit margins.

Examples of bundle pricing

Working with Shopify partner Rebuy—a suite that provides personalization, marketing, and conversion optimization services—Roma Designer Jewelry employed bundle pricing in 2019 with the goal of increasing its AOV.

When shoppers added an item to their cart, a pop-up offered a “Bundle and Save” feature, with a recommended product to pair. As a result of using cross-sell widgets, the company saw an increase of over 21% to AOV, with one in five shoppers buying a product recommended by Rebuy.

“We're constantly rotating through suggestions," Deven Davis, Roma’s Co-Founder told Rebuy. "We’re trying different approaches to get relevant pieces in front of our shoppers.”

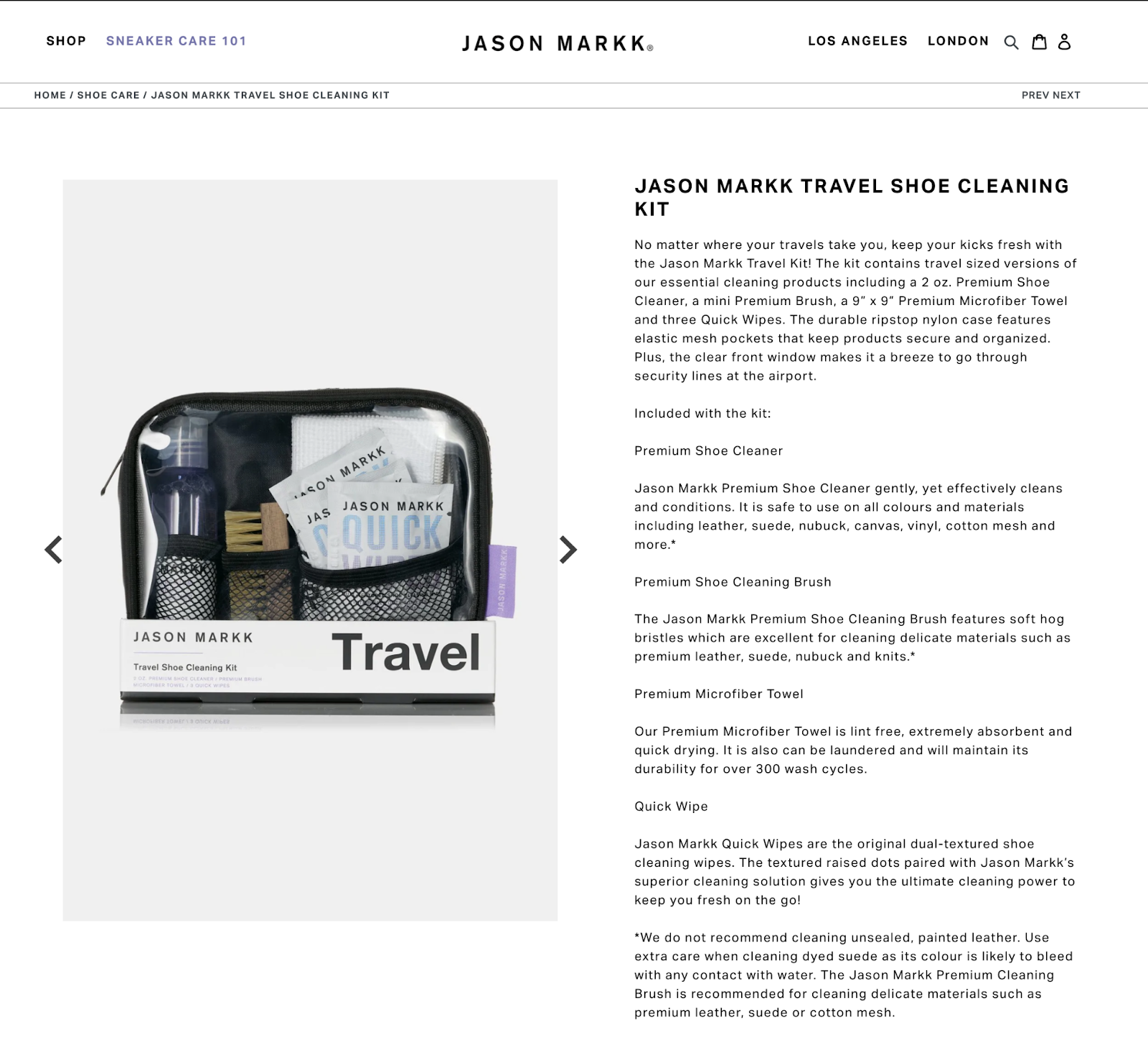

Shoe care brand Jason Markk also offers a version of bundle pricing. While its sneaker wipes, foams and brushes can be purchased individually, it’s cheaper to buy them as part of a cleaning kit.

Examples of psychological pricing

You don’t have to look far to find examples of charm pricing—it’s on nearly every ecommerce site.

Death Wish Coffee sells its bags of beans using the number nine: One pound will cost you $19.99.

But this isn’t the only psychological pricing method Death Wish relies on; it also does a version of anchor pricing, by putting the price for one pound ($19.99) directly beside the price for two pounds ($37.99) and five pounds ($79.99). It doesn’t take a math wizard to determine that buying in bulk results in big savings, resulting in a higher AOV.

Finding the right pricing strategy for success

Choosing an appropriate pricing strategy can mean the difference between making it to the Showcase Showdown or going home empty-handed. But that doesn’t mean you need to rely on one tactic alone—particularly as illustrated through the growth in dynamic pricing.

The same method used by airlines and hotels to sell rooms and flights over peak and slow periods, it’s an algorithm-driven approach that adjusts prices based on market and consumer data and is already being used by eBay and Amazon. It’s estimated that the latter changes its prices more than 2.5 million times a day to set prices lower than their competition.

Read more

- How to Monetize Dormant Customers With a Successful Winback Campaign

- How to Design Customer Surveys That Lead to Actionable Insights

- Overhauling Your Customer Acquisition Model: How to Spend Your Budget Where It Really Counts

- The Science of Impulse Purchases: How to Encourage Your Customers to Buy More on the Fly

- The Master Guide to Google Channel

- Gift Wrapping in Ecommerce: How to Boost AOV This Holiday Season

- Ecommerce Logistics: How to Diversify and Future-Proof Your Supply Chain

- How to Block the Ad Blockers & Whether You Should

- How to Personalize for Unknown Black Friday Cyber Monday Mobile Visitors

- Composable Commerce: What It Means and if It’s Right for Your Business

Ecommerce pricing strategy FAQ

What is the 3-step process to determine pricing?

-

Define your objectives

-

Know your target audience

-

Consider hiring a pricing analyst

What are the 4 types of pricing methods?

-

Competition based pricing

-

Cost-based pricing

-

Value-based pricing

-

Premium pricing

What are the 3 C's of pricing?

The 3 C's of pricing are Cost, Competition, and Customer Value. Cost is how much consumers will pay for the product. Competition is what your competitors charge. Customer value is how customers perceive your brand and its products.

What is the difference between price anchoring and price skimming?

Price anchoring is when a company lists both a discounted price and original price to show how much a customer can save. Price skimming is when a company charges a higher price initially and then reduces it over time.